Investing with the goal of generating returns can be challenging. Many individuals, including professionals and myself, have made errors in investment decisions, whether in stocks or ETFs.

Why investing is important?

You want your money to grow and work for you. Whether it’s stocks, ETFs, or mutual funds, the aim is for your money to increase over time. Timing the markets is almost impossible, which is why time is your ally.

Embarking on your investment journey is crucial for securing significant returns for your future self. Even starting with a small amount, like $5 per week, can lead to substantial growth over time. When invested in the stock market, that $5 can multiply into thousands through the power of compounding.

Why time plays an important factor when it comes to investments?

People who are nearing retirement or are retired, will most likely rely on their investments to help supplement their retirement income and risk plays an important factor in protecting their nest egg no matter how big or small it is.

Your risk profile is influenced by your age. As you get older, it is advisable to allocate the majority of your investments to fixed-income assets such as bonds, money market funds, and GICs. Additionally, maintaining some exposure to blue-chip equities like utilities, banks, and REITs can enhance your portfolio’s returns.

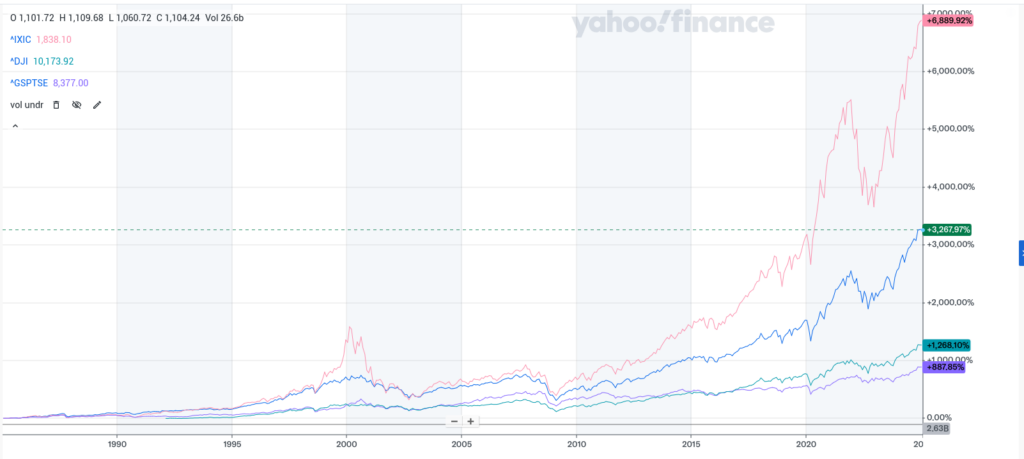

A few years ago, during COVID, global markets fell sharply. The chart below shows the US and Canadian markets. On the left side, you can see a big drop marking the beginning of COVID in early 2020.

No one knew how long it would take for the markets to recover as we entered an age of a global pandemic. Investors lost money, some panic sold and others saw the opportunity to get into the market at a discount or wait it out in hopes that markets recover.

But if you held from 2020’s lows until today, you can see from the graph above, that the lowest return was 53% from Canada’s TSX market and the US’s DJIA returned 103% and the NASDAQ returned a whopping 142%! You would have nearly made 1.5x your money in 4 years time helped by tech stocks like META, GOOGLE, NVIDIA, Microsoft, etc…

How do you choose how to invest?

As previously mentioned, your age matters as it determines your risk profile. If you’re young, you have time on your hands so you portfolio would be majority equities (stocks, or the stock index itself) where if you’re nearing retirement or in retirement, you want your risk to be low as possible and some exposure to equities like bank stocks or utilities as banks are generally safe and pay out a nice dividend.